You’ve probably heard the saying “don’t put all your eggs in one basket.” That’s exactly what diversification is about—spreading your investments so that if one thing goes wrong, your entire portfolio doesn’t crash.

In 2025, with markets constantly changing, interest rates fluctuating, and global uncertainty, having a well-diversified mutual fund portfolio isn’t just smart—it’s essential. Let me show you 10 Tips for Diversifying Your Mutual Fund Portfolio in 2025.

1. Invest Your Money Across Different Asset Types

The foundation of smart diversification is investing in different asset classes. Think of it as having multiple income sources instead of depending on just one job.

- Equity funds: High growth potential but can be volatile (your growth engine)

- Debt funds: Stable and predictable, like your safety net

- Gold funds or ETFs: Protection against inflation and currency drops

- Hybrid funds: The best of both worlds—mixing stocks and bonds

Example portfolio split:

- 60% equity funds (for growth)

- 30% debt funds (for stability)

- 10% gold or international funds (for protection)

This mix helps you grow your wealth while protecting you during market downturns.

2. Don’t Stick to Just One Type of Equity Fund

Even within equity funds, there are different flavors. Mixing them reduces your risk significantly.

- Large-cap funds: Invest in big, established companies like Reliance or TCS. Safer and more stable.

- Mid-cap funds: Medium-sized companies with higher growth potential but more volatility.

- Small-cap funds: Smaller companies that can give explosive returns but come with higher risk.

- Flexi-cap or multi-cap funds: Invest across all company sizes, adjusting based on opportunities.

- Why it matters: When large companies are sluggish, mid-caps might be thriving. When mid-caps correct, large-caps provide stability.

Suggested mix:

- 50% large-cap (foundation)

- 30% flexi-cap (balanced growth)

- 20% mid/small-cap (aggressive growth)

3. Include International or Global Funds

India is growing fast, but putting all your money only in Indian markets means you’re affected by every local problem—elections, monsoons, domestic policy changes.

International or global funds invest in companies outside India—Apple, Microsoft, Amazon, or emerging markets in Asia.

Benefits:

- Your portfolio isn’t just tied to India’s economy

- You benefit from global growth trends

- Currency diversification adds another layer of protection

Even allocating just 10-15% to international funds can significantly improve your portfolio’s stability.

4. Balance Between Active and Passive Funds

This is like choosing between a chauffeur-driven car and a self-driving one.

Active funds: Fund managers actively pick stocks trying to beat the market. Higher fees (1.5-2%) but potential for better returns.

Passive funds (index funds/ETFs): Simply copy an index like Nifty 50. Lower fees (0.2-0.5%) and guaranteed market returns.

Smart approach:

- 60% in active funds (for potential outperformance)

- 40% in passive funds (for low-cost, reliable market returns)

This way, you get the best of both worlds—expert management plus cost efficiency.

5. Mix Growth and Value Investment Styles

Fund managers follow different investment styles such as:

- Growth investing: Focus on companies growing fast (like tech startups, new-age businesses)

- Value investing: Target undervalued, solid companies trading below their true worth

Having both growth and value funds ensures your portfolio performs well under different market conditions.

6. Don’t Put All Your Money in One Sector

Remember when IT stocks crashed? Or when pharma boomed during COVID while everything else tanked? That’s why sector diversification matters.

Invest in sector-diversified funds that cover various industries like:

- Banking & Finance

- IT & Technology

- Pharmaceuticals

- Energy & Infrastructure

- FMCG & Consumer Goods

Choose diversified equity funds rather than sectoral funds. Sectoral funds (like “Banking Fund” or “Pharma Fund”) are too concentrated and risky unless you really understand that sector.

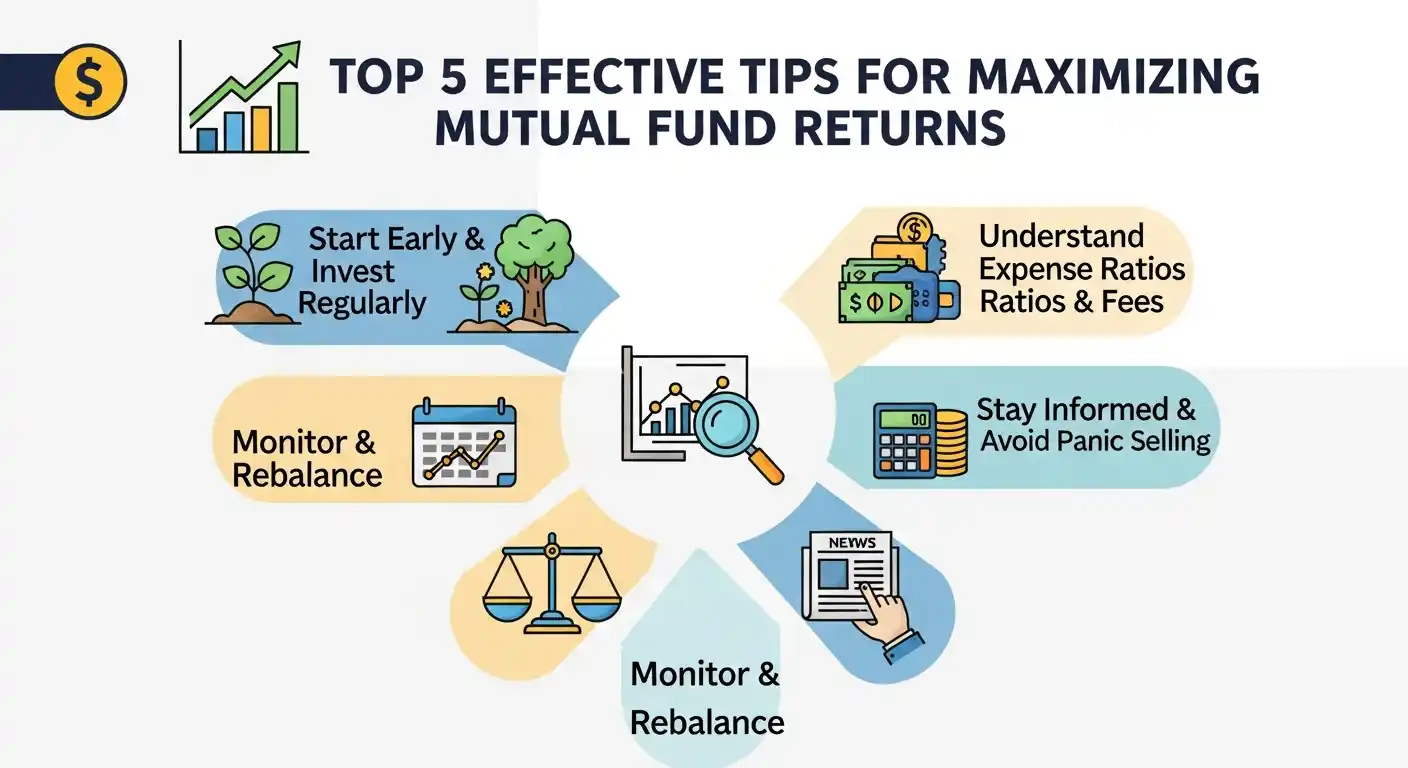

7. Use SIPs for Time Diversification

A Systematic Investment Plan (SIP) is one of the smartest diversification tools available.

How it works: You invest a fixed amount every month—₹3,000, ₹5,000, whatever you can afford.

Why it’s powerful:

- You buy more units when markets are low (prices are cheaper)

- You buy fewer units when markets are high (avoiding overpaying)

- This “rupee-cost averaging” smooths out market volatility over time

- You don’t need to time the market

Think of it as: Buying vegetables—sometimes tomatoes cost ₹20/kg, sometimes ₹80/kg. If you buy every week, your average cost evens out.

8. Avoid the Over-Diversification Trap

Yes, there’s such a thing as too much diversification.

The problem: If you own 20 mutual funds, chances are many of them hold the same stocks. This creates:

- Portfolio overlap (defeating the purpose of diversification)

- Complexity (too hard to track and manage)

- Higher total fees

The sweet spot: 6-10 mutual funds are enough for excellent diversification.

Example well-diversified portfolio (8 funds):

- Nifty 50 Index Fund (large-cap passive)

- Large-cap active fund

- Flexi-cap fund

- Mid-cap fund

- Hybrid/Balanced fund

- Short-term debt fund

- ELSS (tax-saving equity fund)

- International fund

This gives you exposure to everything without unnecessary overlap.

9. Rebalance Your Portfolio Once a Year

Here’s what happens over time: Equity grows faster than debt. Suddenly, your 60:40 equity-debt split becomes 75:25. You’re now taking more risk than you planned.

Rebalancing means: Selling some of the overperforming asset (equity) and buying more of the underperforming one (debt) to restore your original balance.

When to rebalance:

- Once a year (same date every year makes it easy to remember)

- When your allocation shifts by more than 10% from your target

- After major life changes (new job, marriage, kids)

Example:

- Started with: ₹6 lakhs equity, ₹4 lakhs debt (60:40)

- After one year: ₹8 lakhs equity, ₹4.2 lakhs debt (66:34)

- Rebalance: Sell ₹60k equity, buy ₹60k debt to restore 60:40

This forces you to “sell high and buy low” automatically—the golden rule of investing.

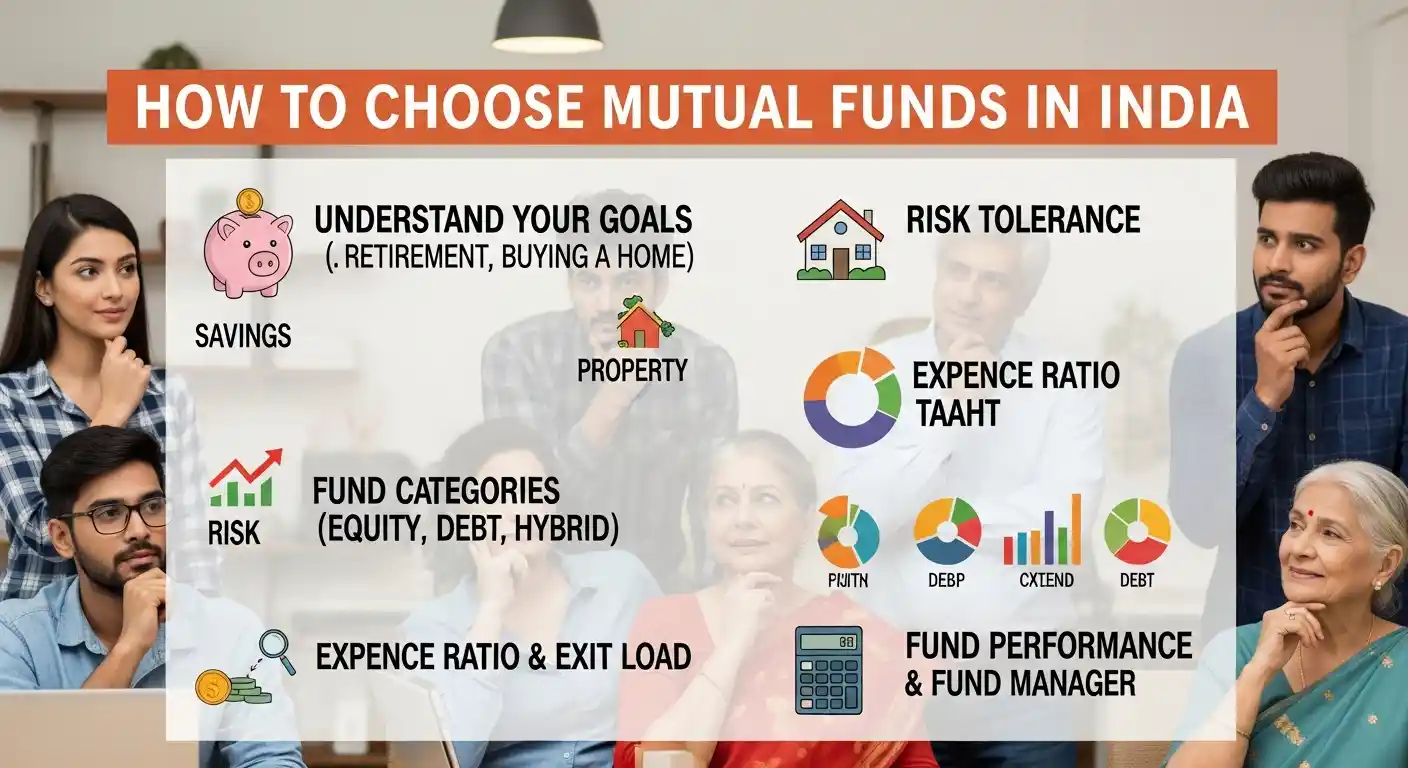

10. Match Diversification With Your Financial Goals

Not everyone needs the same diversification. Your portfolio should match your timeline and objectives.

Short-term goals (1-3 years): Saving for a car, wedding, or vacation

- 70-80% debt funds

- 20-30% large-cap equity

- Focus: Safety over growth

Medium-term goals (3-5 years): Down payment for a house, business startup

- 50% equity (large-cap + flexi-cap)

- 40% debt funds

- 10% gold or international

- Focus: Balanced growth with protection

Long-term goals (5+ years): Retirement, children’s education

- 70-80% equity (mix of all types)

- 15-20% debt

- 5-10% alternatives (gold, international)

- Focus: Maximum growth

Your age also matters:

- 20s-30s: Can take more risk (70-80% equity)

- 40s-50s: Need balance (50-60% equity)

- 55+: Focus on safety (30-40% equity)

Bonus Tip: Check for Hidden Overlaps

Many investors unknowingly own multiple funds that hold the exact same stocks. This defeats the entire purpose of diversification.

How to check:

- Use portfolio overlap tools on Groww, ET Money, or Kuvera

- Check your funds’ top 10 holdings in their fact sheets

- If two funds share more than 60% common stocks, consider removing one

Example: If your “Large Cap Fund” and “Flexi Cap Fund” both have 70% overlap with the same companies, you’re not really diversified—you’re just paying double fees.

Common Diversification Mistakes to Avoid

- Chasing performance: Don’t load up on last year’s best-performing sector. What goes up fast often comes down just as fast.

- Ignoring rebalancing: Your portfolio drifts over time. Set a calendar reminder to review annually.

- Too many funds: More isn’t always better. Quality over quantity.

- Forgetting your goals: Diversification should serve your objectives, not just be random spreading.

- Panic changes: Don’t completely reshuffle your portfolio every time markets fall.

Conclusion

Think of your mutual fund portfolio like a balanced diet. You need proteins (equity for growth), carbs (debt for energy/stability), vitamins (gold for protection), and variety (different sectors and styles) to stay financially healthy.

Diversification isn’t about owning everything—it’s about owning the right mix that helps you sleep peacefully while your money grows steadily.

In 2025, with global uncertainties and market volatility, a well-diversified portfolio is your best defense and your strongest offense. Start with a simple, well-balanced mix, add to it regularly through SIPs, rebalance once a year, and stay patient.

Remember: The goal isn’t to avoid all losses—that’s impossible. The goal is to manage risk while capturing growth opportunities. That’s exactly what smart diversification does.

Learn More: How to Choose Mutual Funds in India

FAQ on Diversifying Your Mutual Fund Portfolio

How many mutual funds do I really need?

6-10 funds are ideal for most investors. Less than 5 might be too concentrated; more than 12 becomes unnecessarily complicated.

Should I diversify across different fund houses?

Yes, spreading across 3-4 different AMCs (like HDFC, ICICI, Axis, SBI) reduces the risk of any single fund house having issues.

What’s the biggest diversification mistake beginners make?

Buying too many funds without checking for overlap. They think they’re diversified but actually own the same stocks multiple times.

How often should I review my portfolio?

Every 6 months for a quick check, and once a year for detailed review and rebalancing.

Can I diversify with just index funds?

Yes! A simple portfolio of Nifty 50 Index + Nifty Next 50 + Debt Index fund can give you excellent diversification at very low cost.

Is gold really necessary in 2025?

While not mandatory, 5-10% allocation to gold funds helps during market crashes and currency crises. It’s insurance for your portfolio.

What if I’ve already over-diversified?

Start consolidating. Check for overlaps, exit underperforming or duplicate funds gradually, and move toward 6-8 quality funds.

Disclaimer: This article is for educational purposes only and not personalized investment advice. Mutual fund investments are subject to market risks. The suggested allocations are examples and may not suit everyone. Please read all scheme documents carefully and consult a certified financial advisor to create a portfolio based on your specific goals, risk tolerance, and financial situation.