Managing multiple mutual fund investments across different fund houses can feel overwhelming. You might have some units with HDFC Mutual Fund, others with ICICI Prudential, and more with SBI—each sending separate statements. Keeping track of everything becomes a nightmare.

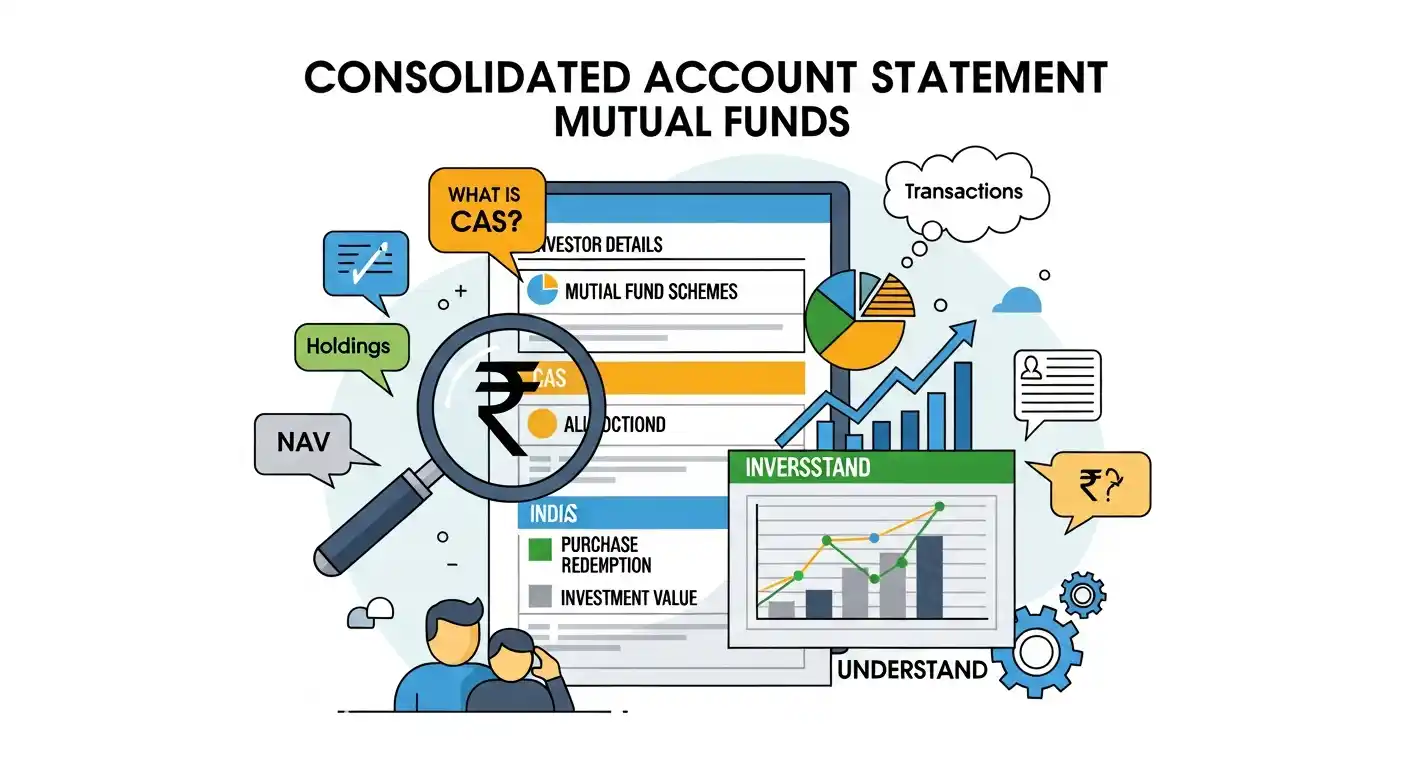

That’s where the Consolidated Account Statement (CAS) comes in. Think of it as a single report card that shows all your mutual fund investments in one place, making your financial life much simpler.

In this comprehensive guide, I’ll explain everything you need to know about CAS—what it is, why it matters, how to get it, and how to read it effectively.

What is a Consolidated Account Statement (CAS)?

A Consolidated Account Statement (CAS) is a single document that provides a complete summary of all your mutual fund investments across different Asset Management Companies (AMCs).

Instead of receiving separate statements from each fund house, CAS gives you one unified view of your entire mutual fund portfolio.

If individual statements are like report cards from different schools, CAS is like having all your grades compiled into one master report card. It consolidates information on your investments across various AMCs, including details like:

- Mutual fund schemes you are invested in

- Number of units held in each scheme

- Transaction history (purchases, redemptions, switches)

- Current Net Asset Value (NAV) of each scheme

- Market value of your holdings

Who Issues CAS?

CAS is issued by two organizations:

- CAMS (Computer Age Management Services)

- KFintech (Karvy Fintech)

These are the two main Registrar and Transfer Agents (RTAs) in India that maintain investor records for most mutual fund houses.

Types of CAS

- Monthly CAS: Issued if you had any transaction (purchase, redemption, switch) during the month.

- Half-yearly CAS: Issued every six months (June and December) even if you had no transactions, showing your holdings as of that date.

- Detailed CAS: Contains comprehensive information including all transactions.

- Summary CAS: Shows only your current holdings without detailed transaction history.

Importance of CAS to Mutual Fund Investors

A CAS offers several benefits for investors, some of which are mentioned below:

- Consolidated View: It provides a single window view of all your mutual fund investments, regardless of the number of fund houses or schemes you have invested in.

- Simplified Tracking: It simplifies the process of tracking your portfolio’s performance, making it easy to monitor your investments and identify areas for improvement.

- Informed Decision-Making: By providing a clear overview of your investments, CAS helps you make informed decisions about your investment strategy, such as rebalancing your portfolio or switching to different funds.

- Easy Access to Information: You can easily access important information such as your investment history, transaction details, and tax-related documents.

- Enhanced Security: CAS ensures the security of your investment information by implementing robust security measures.

How to Generate a Consolidated Account Statement

To generate a CAS, you can follow these steps:

- Visit the CAMS or Karvy Website: You can access the CAS portal through the websites of CAMS or Karvy, two of the largest registrar and transfer agents in India.

- Provide Necessary Information: You will need to provide your PAN, mobile number, and email address to access your account.

- Verify Your Identity: You may need to verify your identity through a one-time password (OTP) or other authentication methods.

- Generate Your CAS: Once your identity is verified, you can generate your CAS.

You can also request a physical CAS from your Registrar and Transfer Agent (RTA) like CAMS or Karvy. However, the offline method maybe more time-consuming than the online one.

How Do AMCs Compute Consolidated Account Statement?

AMCs collect and process data from various sources, including their own systems and the systems of registrar and transfer agents. This data is then consolidated into a single, unified view of your mutual fund investments.

What are the Contents of a Consolidated Account Statement?

A CAS typically includes the following information:

- Investor details (name, PAN)

- AMC details

- Scheme details (scheme name, investment type)

- Transaction details (date, type, amount, units)

- Current holdings (number of units, NAV, market value)

- Dividend/bonus details (if applicable)

Advantages and Disadvantages of Consolidated Account Statement

Now that we have discussed in detail what a CAS is and how it helps investors, let’s take a look at some more of its advantages, and also a few of the disadvantages:

Advantages:

- Simplified Investment Tracking: It provides a consolidated view of all your investments, making it easy to track performance and make informed decisions.

- Enhanced Security: It ensures the security of your investment information by implementing robust security measures.

- Easy Access to Information: You can easily access important information such as your investment history, transaction details, and tax-related documents.

Disadvantages:

- Technical Issues: Sometimes, there may be technical glitches or delays in generating the CAS.

- Data Accuracy: While AMCs strive to provide accurate data, there may be occasional errors or discrepancies.

Wrapping Up

The Consolidated Account Statement is one of the most useful tools available to mutual fund investors in India. It brings order to what could otherwise be chaos, especially if you invest across multiple fund houses.

By providing a single, comprehensive view of your entire mutual fund portfolio, CAS simplifies tracking, monitoring, and managing your investments. It saves time, reduces clutter, and makes tax filing significantly easier.

While it has minor limitations—like potentially receiving multiple statements from different RTAs—the benefits far outweigh the drawbacks.

Make it a habit to review your CAS regularly. Use it not just as a record-keeping tool but as an active part of your investment monitoring process. Combined with online portfolio trackers and periodic reviews, CAS helps you stay on top of your financial journey.

Remember: An informed investor is an empowered investor. And CAS is your window into staying informed about every rupee you’ve invested in mutual funds.

Related Post:

- 10 Tips for Diversifying Your Mutual Fund Portfolio in 2025

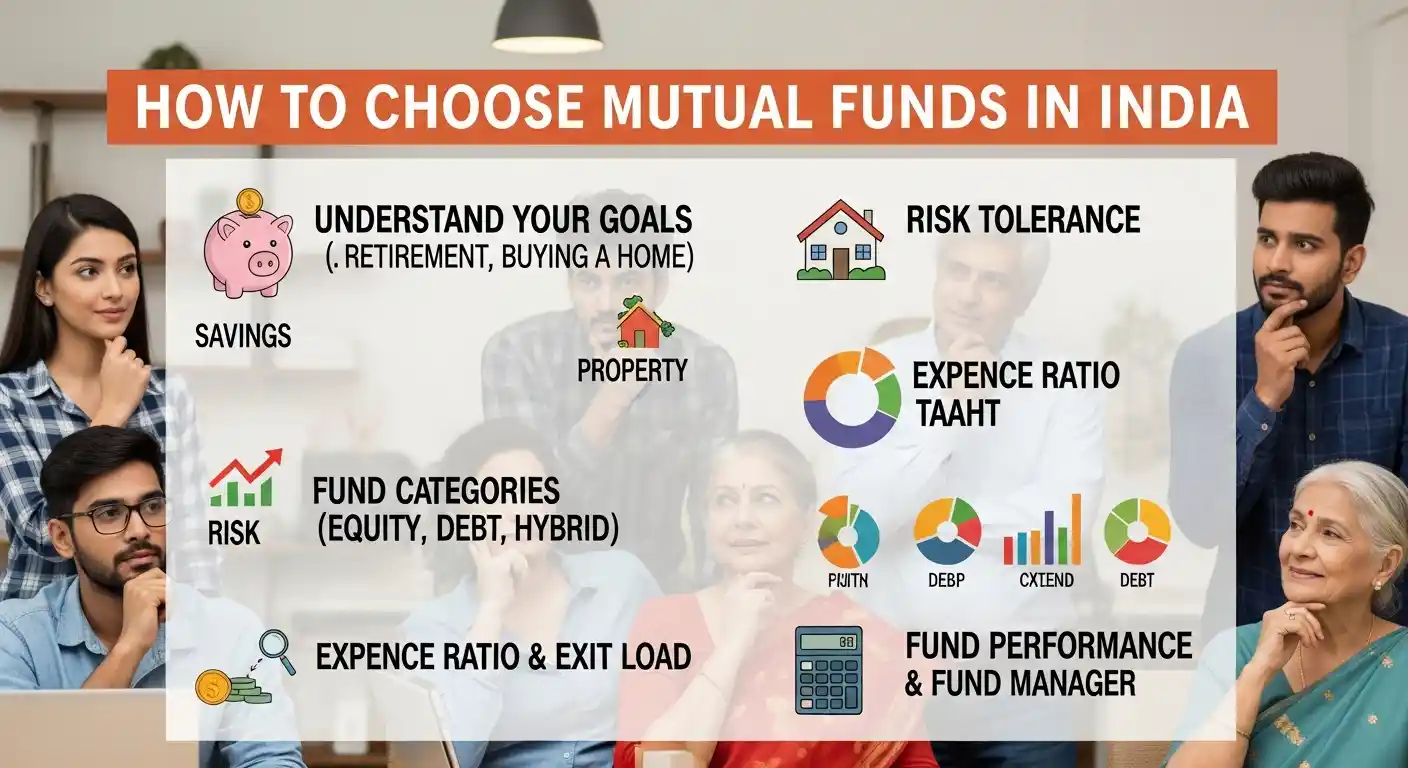

- How to Choose Mutual Funds in India in 2025

- Mutual Funds for Retirement Planning: Invest Wisely, Retire Comfortably

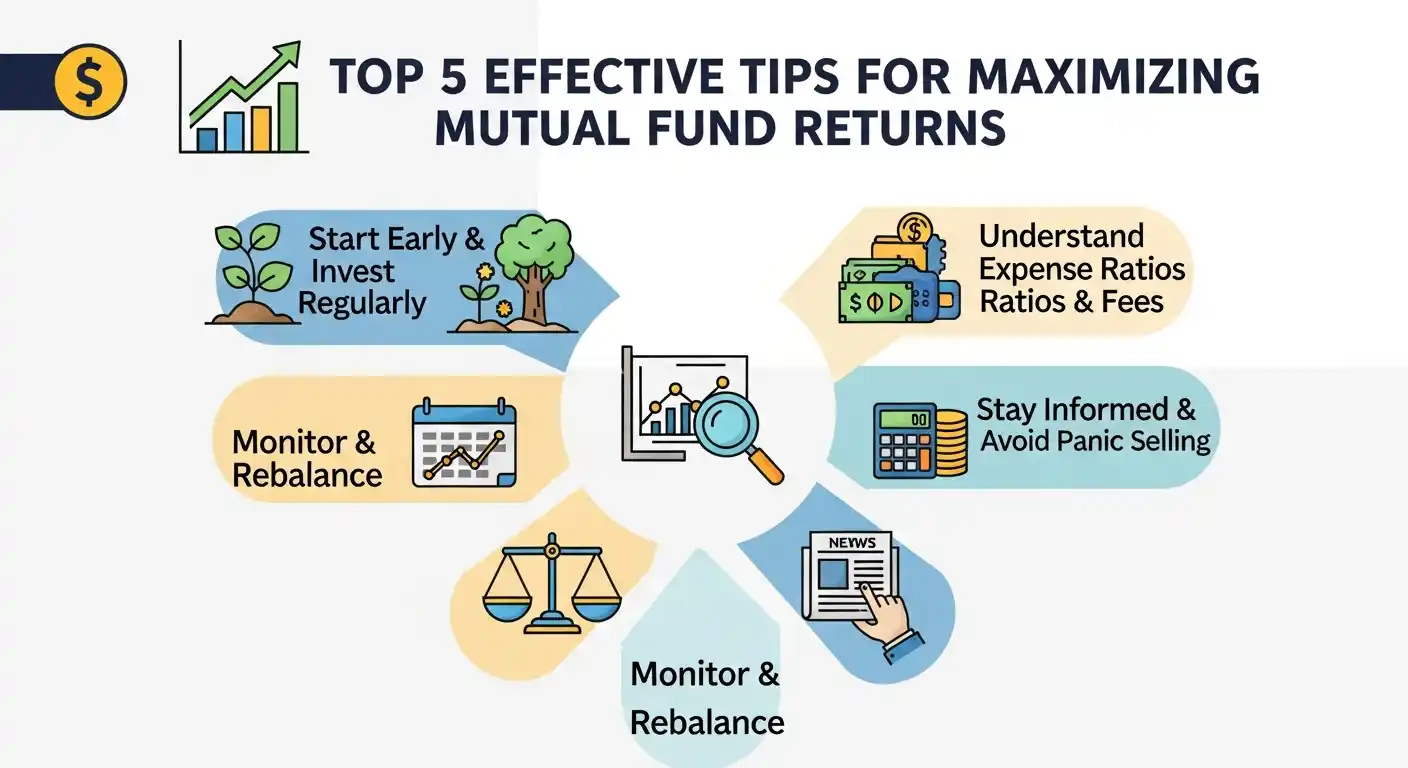

- Top 5 Effective Tips for Maximizing Mutual Fund Returns

Frequently Asked Questions on Consolidated Account Statement (CAS)

1. What is the password for CAS PDF?

The password is your date of birth in DDMMYYYY format. For example, if you were born on 5th April 1990, your password is 05041990. Make sure to include leading zeros.

2. Why am I receiving two different CAS?

You’re likely receiving one from CAMS and one from KFintech because you have investments in AMCs serviced by both RTAs. This is normal and together they cover all your investments.

3. My recent transaction isn’t showing in CAS. Why?

CAS is generated monthly or half-yearly with a cut-off date. Transactions made after the cut-off date will appear in the next CAS. For real-time updates, check your AMC’s app or website.

4. I haven’t received my CAS via email. What should I do?

First, check your spam folder. If it’s not there, visit the CAMS or KFintech website and request CAS using your PAN and registered email. Also verify that your email is correctly registered with your AMCs.

5. Can I use CAS for filing income tax returns?

Yes! CAS contains all transaction details and capital gains information, making it very useful for ITR filing. Many tax professionals specifically ask for CAS to simplify the process.

6. Is CAS available for all types of mutual fund investments?

Yes, CAS covers all mutual fund schemes—equity, debt, hybrid, ELSS, and others—as long as they’re registered with CAMS or KFintech.

7. How long should I keep my CAS records?

Keep CAS for at least 7 years. This helps with tax compliance, capital gains calculation, and maintaining investment records. Digital copies take no space, so keeping them longer doesn’t hurt.

8. Can I get CAS for my joint holdings?

Yes, if you have joint holdings, CAS will show investments where you are the primary holder. The second holder will receive their own CAS for investments where they are primary.

9. Does CAS show nominee details?

Yes, CAS includes nominee information for each folio, helping you verify that your nominee details are correctly recorded.

10. Is there a mobile app to view CAS?

While CAMS and KFintech don’t have dedicated apps just for CAS, many investment platforms like Groww, Zerodha, and ET Money allow you to view and download CAS through their apps.

Disclaimer: This article is for educational purposes only. While CAS is an official document issued by SEBI-registered RTAs, always verify important information with your respective AMCs. For tax-related matters, consult a qualified chartered accountant. Investment decisions should be made after careful consideration of your financial goals and risk tolerance.