Mutual funds have become one of the easiest and most popular ways for Indians to grow their wealth. With digital platforms making investing simple, better regulations protecting investors, and more people becoming financially aware, 2025 is a great time to start your investment journey.

But here’s the challenge—with thousands of mutual funds available, how do you pick the right ones? In this guide, I’ll walk you through everything you need to know to choose mutual funds that actually match your goals and help you build real wealth.

What Are Mutual Funds?

Think of a mutual fund as a big pot where many investors pool their money together. A professional fund manager then uses this money to buy stocks, bonds, or other investments on everyone’s behalf.

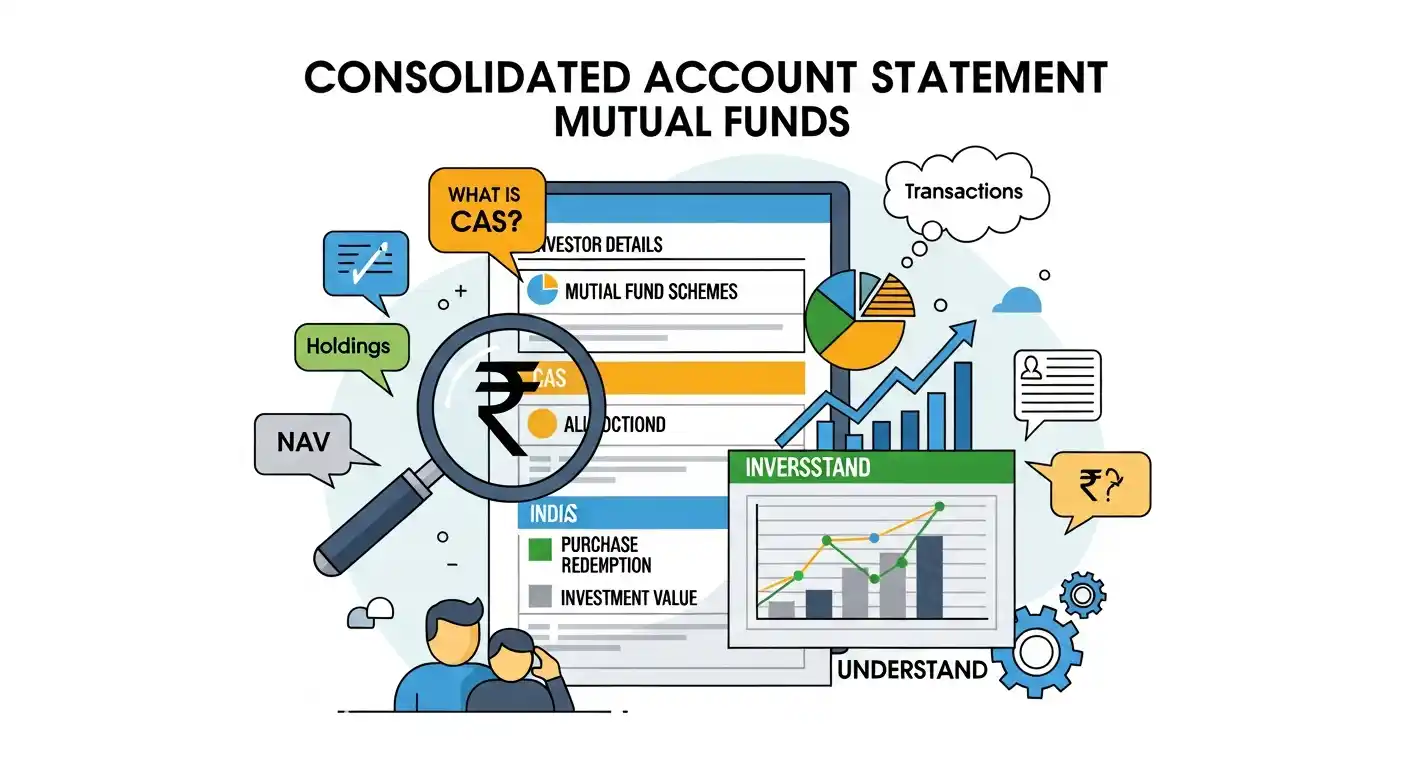

When you invest in a mutual fund, you get “units” based on how much you put in. Each unit has a value called NAV (Net Asset Value), which changes daily based on how the investments are performing.

It’s like ordering a thali at a restaurant—you get a complete meal (diversified investments) prepared by an expert chef (fund manager) instead of having to pick and cook each dish yourself.

Why Should You Invest in Mutual Funds in 2025?

The year 2025 presents several advantages for mutual fund investors in India:

- Complete transparency: You can now track and compare funds easily through SEBI-approved apps and websites.

- Something for everyone: Whether you’re cautious or aggressive, there’s a fund that fits your style.

- Tax savings: Certain funds (ELSS) help you save up to ₹46,800 in taxes under Section 80C.

- Expert management: Professional fund managers do all the hard work for you.

- Easy to buy and sell: Most mutual funds can be bought or sold within minutes on your phone.

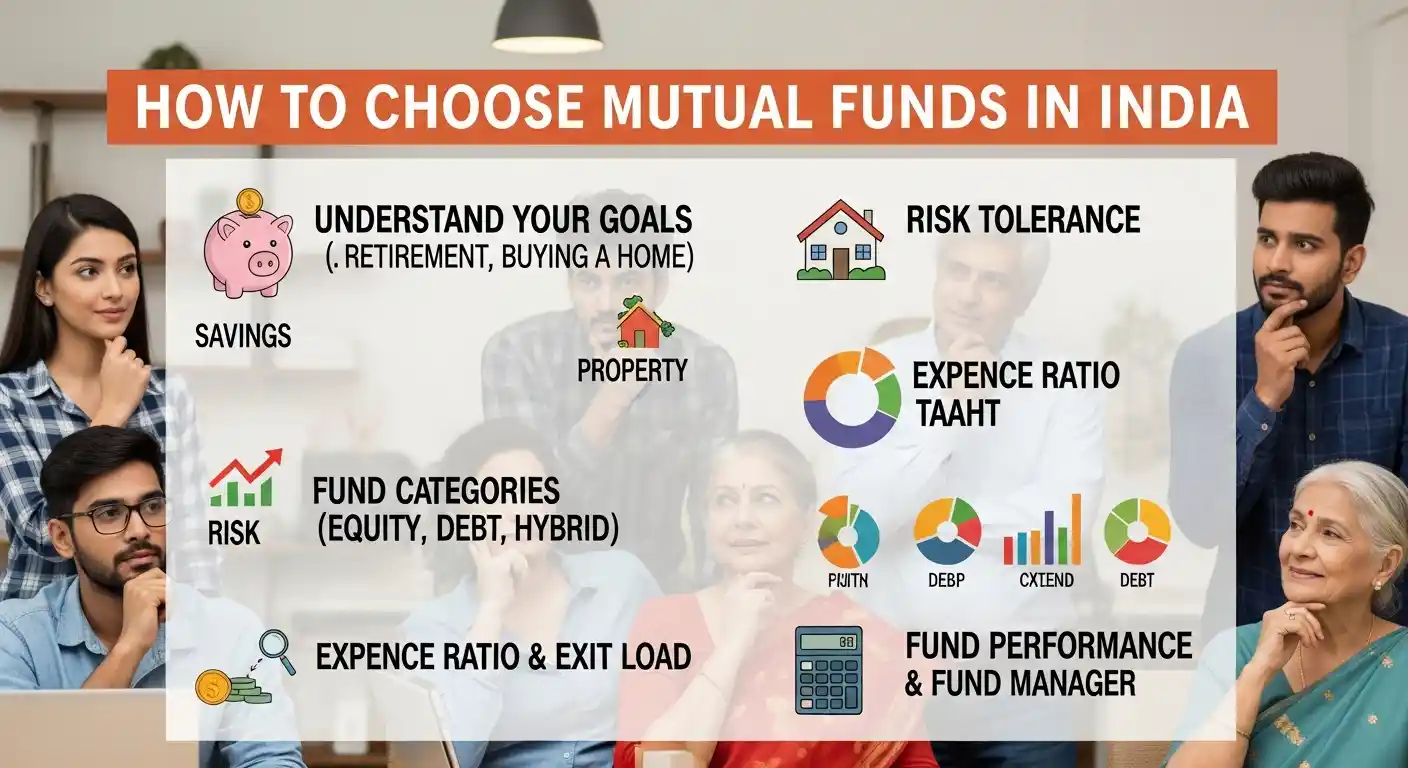

How to Choose the Right Mutual Fund: Your Step-by-Step Plan

Step 1: Know What You’re Investing For

Before investing, clearly identify your financial objectives. Are you investing for short-term goals like a vacation, or long-term goals like retirement or your child’s education?

- Short-term goals (1–3 years): Saving for a vacation, wedding, or car down payment? Go with debt funds or liquid funds—they’re safer and more stable.

- Medium-term goals (3–5 years): Planning to buy a house or fund a course? Consider hybrid funds that mix stocks and bonds.

- Long-term goals (5+ years): Building a retirement fund or your child’s education corpus? Equity funds give you the best growth over time.

Pro tip: Never invest money you’ll need in the next 6 months in mutual funds. Keep that in your savings account or fixed deposit.

Step 2: Understand Your Risk Comfort Level

How do you feel when markets go down? Would you panic and sell, or stay calm?

- Risk-averse (can’t handle losses): Stick to debt funds or conservative hybrid funds. Your returns will be lower, but you’ll sleep peacefully.

- Moderate risk (okay with some ups and downs): Balanced advantage funds or multi-asset funds work well—they adjust between stocks and bonds automatically.

- Risk-taker (can handle volatility): Go for equity funds, especially small-cap or mid-cap funds. Higher risk, but potentially higher rewards.

Every mutual fund shows a “Riskometer” (from low to very high risk). Match it with your comfort level.

Step 3: Pick the Right Fund Category

There are several types of mutual funds. Here’s what each does:

| Fund Type | What It Invests In | Best For | Example |

|---|---|---|---|

| Equity Funds | Stocks of companies | Long-term growth (5+ years) | Axis Bluechip Fund |

| Debt Funds | Bonds and fixed-income | Safety and stable returns | HDFC Short Term Debt Fund |

| Hybrid Funds | Mix of stocks and bonds | Balanced returns with moderate risk | ICICI Balanced Advantage Fund |

| Index Funds | Copies Nifty 50 or Sensex | Passive investors who want market returns | Nippon India Index Fund |

| ELSS Funds | Tax-saving equity funds | Tax deduction + long-term growth | Mirae Asset Tax Saver Fund |

If you’re just starting, begin with a Nifty 50 index fund or a large-cap equity fund. They’re easier to understand and less volatile.

Step 4: Check Past Performance (But Don’t Obsess Over It)

Past performance doesn’t guarantee future results, but it does tell you if a fund has been managed consistently well.

What to look for:

- Has the fund beaten its benchmark (like Nifty 50) over the last 3-5 years?

- Has it performed better than similar funds in its category?

- Is the performance consistent, or does it have wild swings?

Useful metrics to check:

- Sharpe Ratio: Higher is better—shows good returns for the risk taken

- Standard Deviation: Lower means less volatility

- Alpha: Positive alpha means the fund beat its benchmark

You can find all this data on platforms like Groww, ET Money, or the AMC‘s official website.

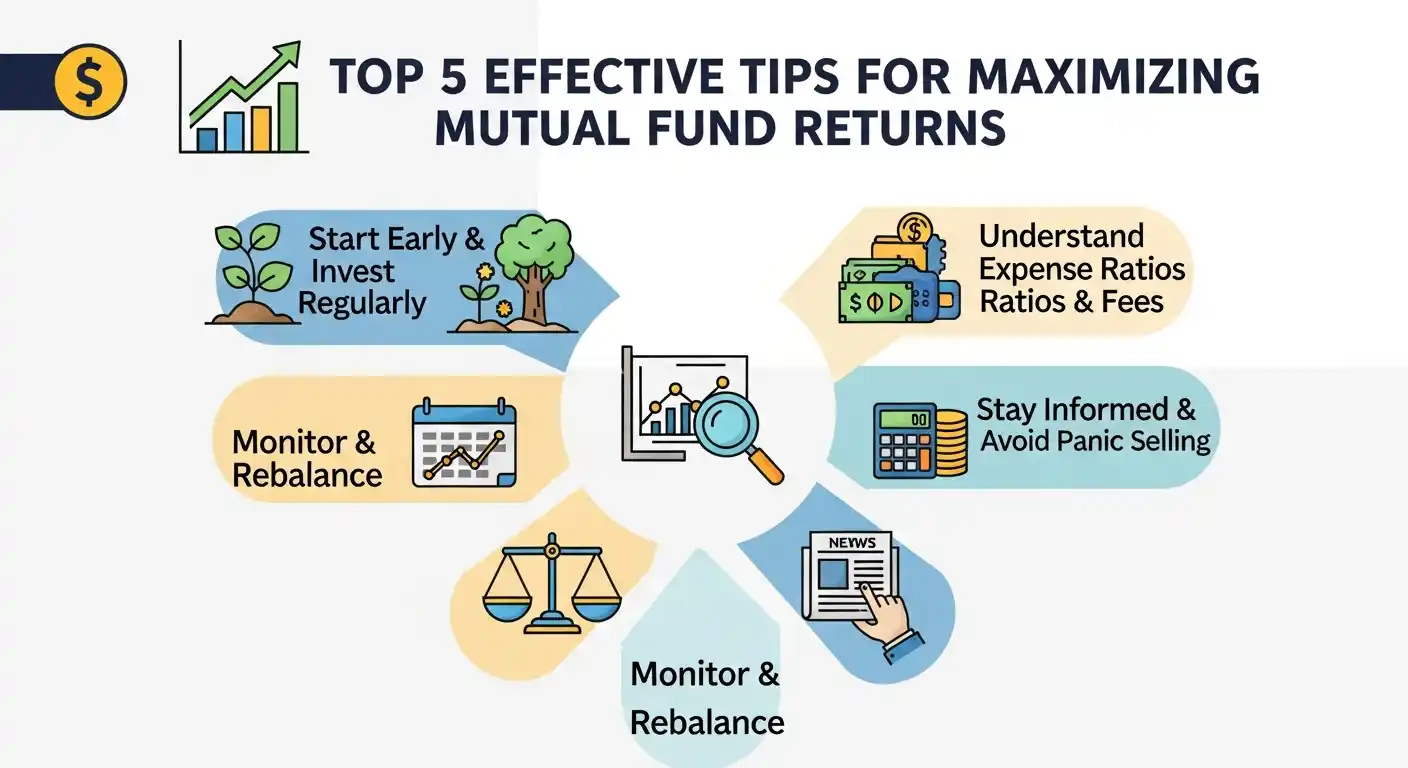

Step 5: Compare Expense Ratios (This Matters!)

Every mutual fund charges a fee for managing your money, called the expense ratio.

- Regular plan: Charges 1.5-2% annually (includes distributor commission)

- Direct plan: Charges 0.5-1% annually (no middleman, you invest directly)

- Why it matters: A 1% difference in fees can reduce your final corpus by lakhs over 20 years due to compounding.

Always choose direct plans when possible. You can invest through the fund house website or platforms like Kuvera, Groww, or Zerodha Coin.

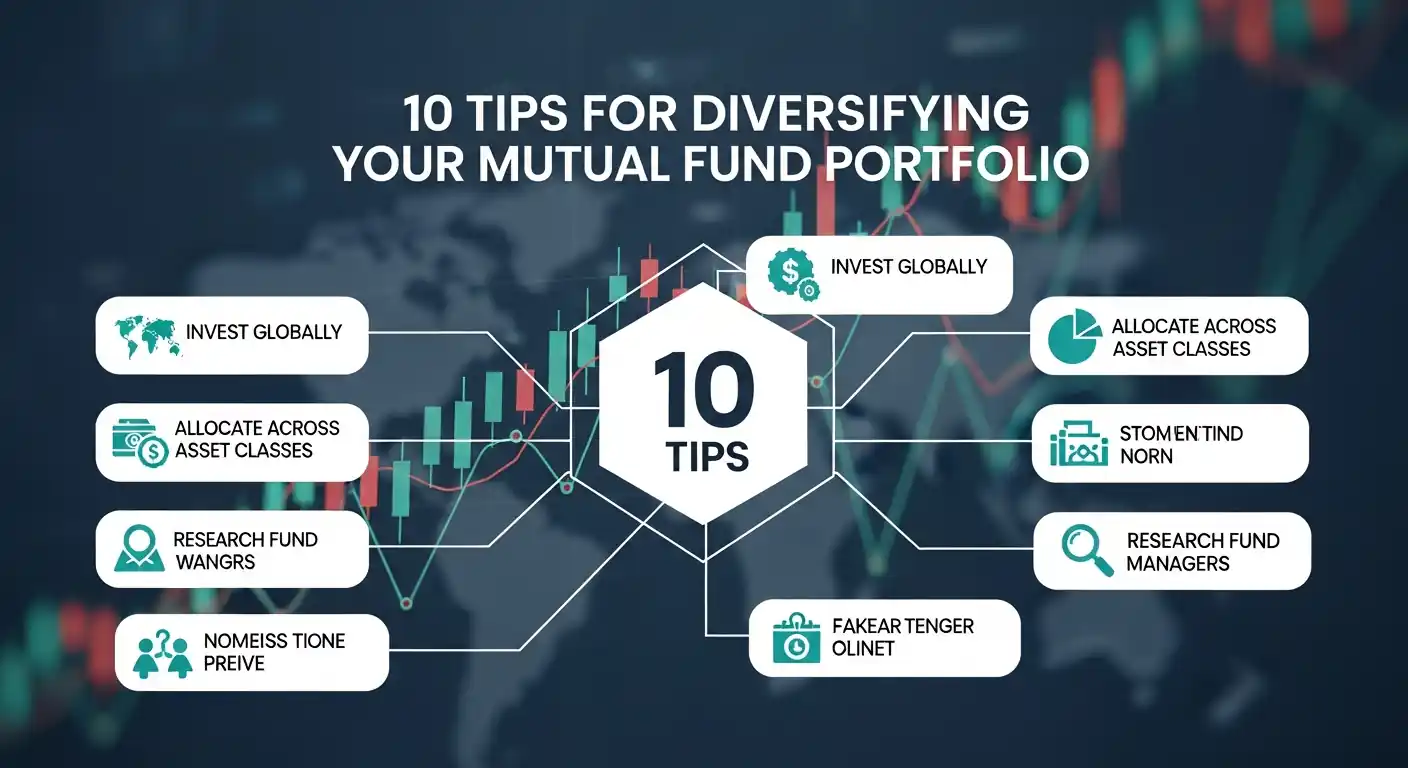

Step 6: Check Who’s Managing Your Money

A fund’s performance depends heavily on the fund manager’s skill and experience.

What to check:

- How many years of experience does the manager have?

- How have their other funds performed?

- Have they stayed with this fund for a while, or do managers change frequently?

Frequent fund manager changes can disrupt a fund’s strategy and performance. Look for stability.

Step 7: Look at What the Fund Actually Owns

Don’t just look at the fund’s name—check what it actually invests in.

For equity funds:

- Is it spread across different sectors (IT, banking, pharma, etc.)?

- Does it invest in just 20 stocks or over 50? (More is usually safer)

- Are the top 10 stocks less than 50% of the portfolio? (Good diversification)

For debt funds:

- Are the bonds AAA-rated? (Safest)

- What’s the average maturity period?

You can find portfolio details in the fund’s monthly fact sheet on the AMC website.

Step 8: Understand the Tax You’ll Pay

Understanding the taxation of mutual funds helps in smarter planning.

- Equity Funds:

- Short-Term Capital Gains (STCG) – 15% (if sold within 1 year)

- Long-Term Capital Gains (LTCG) – 10% above ₹1 lakh

- Debt Funds:

- Taxed as per your income tax slab, as indexation benefits were removed after April 2023.

- ELSS Funds:

- Lock-in period of 3 years, but eligible for Section 80C tax deduction up to ₹1.5 lakh.

Step 9: Check the Fund’s Size

A very small Asset Under Management (AUM) may lead to high volatility and lower liquidity.

On the other hand, an extremely large fund might find it difficult to outperform due to scale.

Ideally, select funds with moderate AUMs (₹2,000 crore to ₹20,000 crore) and consistent investor inflows.

Step 10: Review Your Investments Regularly

Investment is not a one-time activity.

Monitor your fund’s performance every 6 months and compare it with its benchmark index.

If your fund consistently underperforms, consider switching to a better-performing one.

Rebalance your portfolio annually to align with your risk tolerance and financial goals.

Top Performing Mutual Funds in India (2025)

Here are some funds that have performed well in early 2025 (based on publicly available data):

| Fund Name | Category | 5-Year CAGR (%) | Expense Ratio |

|---|---|---|---|

| Parag Parikh Flexi Cap Fund | Flexi Cap | 18.6 | 0.74% |

| Axis Bluechip Fund | Large Cap | 15.2 | 0.64% |

| Quant Active Fund | Multi Cap | 20.1 | 0.78% |

| ICICI Prudential Balanced Advantage Fund | Hybrid | 12.9 | 0.65% |

| Mirae Asset Tax Saver Fund | ELSS | 17.8 | 0.70% |

(Note: Data for illustrative purposes only.)

Common Mistakes to Avoid

- Chasing last year’s top performers: Just because a fund gave 30% returns last year doesn’t mean it will repeat.

- Investing based on tips: Don’t invest just because someone said “this fund is great.”

- Ignoring expense ratios: That 1-2% fee eats into your returns significantly over time.

- Putting all money in one fund: Diversify across 3-4 different types of funds.

- Checking NAV daily: Markets fluctuate. Don’t panic over daily movements.

- Exiting too soon: Give equity funds at least 3-5 years to perform.

Final Thoughts

Choosing the right mutual fund isn’t about finding the “best” fund—it’s about finding the right fund for YOU. Your goals, timeline, and risk appetite should drive your decision, not market hype or fancy names.

Start with one or two simple funds—maybe a Nifty 50 index fund and an ELSS fund for tax savings. As you learn more and get comfortable, you can diversify into other categories.

Remember: Investing is a marathon, not a sprint. The magic happens when you invest consistently over years, not when you try to time the market perfectly.

Start small, stay disciplined, review regularly, and watch your wealth grow steadily over time.

How many mutual funds should I invest in?

3-5 funds are enough for most people. More than 10 becomes too complicated to track and doesn’t add much value.

SIP or lumpsum—which is better?

SIP (monthly investing) is better for most people because it removes the pressure of timing the market and builds discipline. Lumpsum works if you have a windfall and markets are low.

Can I lose all my money in mutual funds?

It’s extremely rare, especially in diversified equity or debt funds. Even in market crashes, funds eventually recover if you stay invested long enough.

Which is the safest mutual fund?

Liquid funds and overnight funds are the safest, with very low risk. But they also give lower returns (4-6% annually).

When should I exit a mutual fund?

Exit if the fund consistently underperforms for 2-3 years, the fund manager leaves, the investment strategy changes dramatically, or you’ve reached your financial goal.

Disclaimer: This article is for educational purposes only and not financial advice. Mutual fund investments are subject to market risks. Past performance doesn’t guarantee future results. Please read all scheme documents carefully and consult a certified financial advisor before investing based on your personal circumstances.